Top 10 Challenges in Modern Oil and Gas Production

The global energy landscape is in a state of profound transformation. The oil and gas industry, a long-standing titan, finds itself at a critical juncture, grappling with a complex web of economic, environmental, and technological challenges. For decades, the rhythm of production seemed predictable, but today, operators navigate a far more turbulent and unpredictable environment. From the boardroom to the drill site, companies are being forced to rethink strategy, innovate at an unprecedented pace, and adapt to a new set of rules.

This in-depth blog post explores the top 10 challenges shaping modern oil and gas production. We will dissect each issue, examining its root causes, its far-reaching impacts, and the innovative strategies being deployed to turn these obstacles into opportunities.

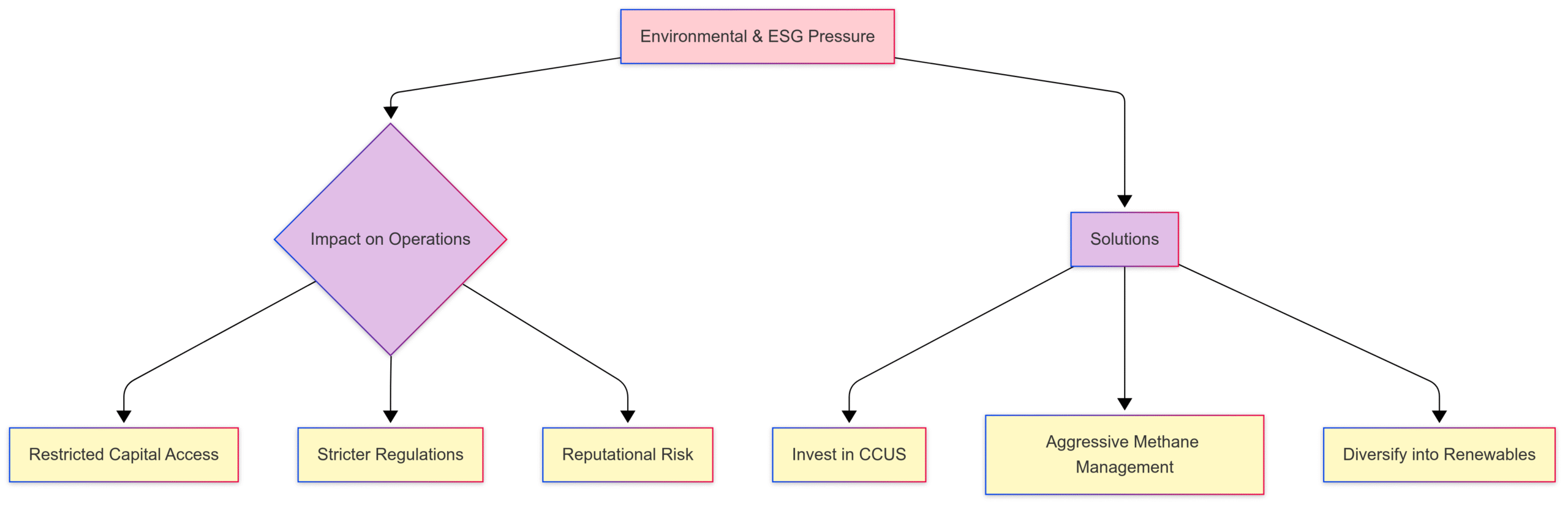

1. The Relentless Pressure of Environmental Scrutiny and the ESG Imperative

The social license to operate for oil and gas companies is no longer a given. Mounting public and investor pressure regarding climate change has placed the industry under an intense environmental microscope. This isn’t just about public perception; it’s about tangible business risk.

The Challenge: The core business of extracting and processing hydrocarbons is inherently linked to greenhouse gas emissions, particularly carbon dioxide (CO_2) and methane (CH_4). Stakeholders, from large institutional investors to the general public, are demanding greater transparency and a clear commitment to Environmental, Social, and Governance (ESG) principles. This translates to rigorous emissions reporting, sustainable operational practices, and a clear roadmap toward decarbonization.

Impacts:

Restricted Access to Capital: Investment funds are increasingly screening for ESG performance, divesting from companies with poor environmental records.

Increased Regulatory Burden: Governments are imposing stricter environmental regulations, including carbon taxes and emissions caps.

Reputational Damage: Oil spills, gas flaring, and high emissions profiles can lead to significant brand damage and public backlash.

Solutions:

Investment in Carbon Capture, Utilization, and Storage (CCUS): Technologies that capture CO_2 emissions from industrial processes and store them underground are becoming a key focus.

Methane Leak Detection and Repair (LDAR): Deploying advanced sensors and drones to identify and fix methane leaks across the value chain.

Diversification into Renewables: Many major oil and gas companies are rebranding as “energy companies,” investing heavily in wind, solar, and hydrogen projects.

2. Navigating the Complex Maze of Regulatory Compliance

Hand-in-hand with environmental pressure comes an ever-tightening web of regulations. The legal and regulatory landscape for oil and gas is in constant flux, varying significantly by region and becoming more stringent each year.

The Challenge: Companies must navigate a labyrinth of local, national, and international laws governing everything from exploration permits and drilling safety to emissions standards and chemical usage. Keeping abreast of these changes and ensuring compliance across all operations is a monumental task.

Impacts:

Increased Operational Costs: Compliance requires significant investment in monitoring technology, reporting systems, and specialized personnel.

Project Delays and Cancellations: Failure to meet regulatory hurdles can halt projects in their tracks, leading to massive financial losses.

Hefty Fines and Penalties: Non-compliance can result in severe financial penalties and legal action.

Solutions:

Regulatory Technology (RegTech): Implementing AI-powered software to track regulatory changes in real-time and automate compliance reporting.

Proactive Stakeholder Engagement: Working closely with regulatory bodies to understand upcoming changes and contribute to the development of workable standards.

Integrated Compliance Management Systems: Establishing centralized systems to ensure that all business units are aware of and adhering to their regulatory obligations.

3. Price Volatility and Geopolitical Instability

The oil and gas market has always been cyclical, but recent years have seen unprecedented volatility. Prices can swing dramatically based on a dizzying array of factors, making long-term planning a high-stakes guessing game.

The Challenge: Crude oil and natural gas prices are exquisitely sensitive to geopolitical events, from conflicts in major producing regions to shifting trade policies and OPEC+ decisions. This inherent instability creates a challenging environment for making capital-intensive investment decisions.

Impacts:

Unpredictable Revenue Streams: Price fluctuations make it difficult to forecast revenues and manage budgets effectively.

Investment Hesitancy: Volatility can deter investment in long-cycle projects, as future profitability is uncertain.

Supply Chain Disruptions: Geopolitical tensions can disrupt critical supply routes, leading to logistical nightmares and increased costs.

Solutions:

Financial Hedging: Using financial instruments like futures and options to lock in prices and mitigate the risk of price downturns.

Scenario Planning: Developing robust models that simulate the impact of various geopolitical and market scenarios on the business.

Focus on Cost Efficiency: Driving down production costs to ensure profitability even in lower price environments.

4. The Accelerating Energy Transition and Competition from Renewables

The global shift towards a low-carbon energy system is arguably the most significant long-term challenge facing the oil and gas industry. As renewable energy sources like solar and wind become increasingly cost-competitive, the demand landscape for hydrocarbons is fundamentally changing.

The Challenge: Oil and gas companies are no longer just competing with each other; they are competing with a rapidly growing renewable energy sector. The narrative of “peak oil demand” is gaining traction, forcing companies to contemplate a future where their core products play a diminished role.

Impacts:

Stranded Assets: The risk that oil and gas reserves may become economically unviable to extract before they are depleted.

Shifting Investor Preferences: Capital is increasingly flowing towards companies with clear energy transition strategies.

Pressure to Diversify: The need to evolve business models beyond traditional exploration and production.

Solutions:

Investing in “Blue” and “Green” Hydrogen: Leveraging existing infrastructure and expertise to produce low-carbon hydrogen.

Developing Biofuels: Investing in the production of fuels derived from organic matter.

Strategic Partnerships: Collaborating with renewable energy companies and technology startups to gain expertise and market access.

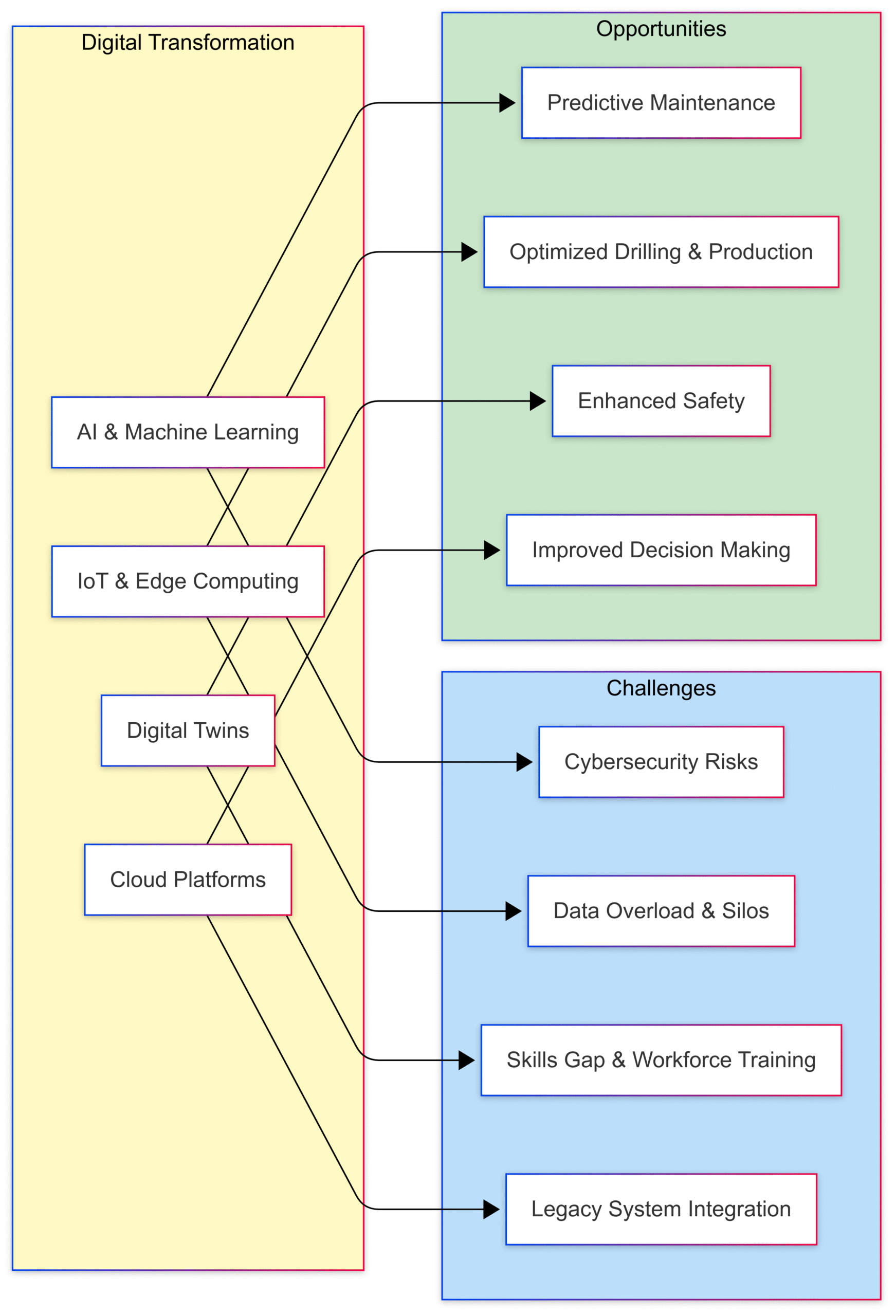

5. The Double-Edged Sword of Digitalization and AI

The fourth industrial revolution has arrived in the oil and gas sector. Digital technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing offer immense potential to improve efficiency, safety, and decision-making. However, this digital transformation is not without its challenges.

The Challenge: Integrating these new technologies with legacy systems, managing the massive volumes of data generated, and ensuring the cybersecurity of increasingly connected operations are major hurdles.

Impacts:

Cybersecurity Vulnerabilities: Connected infrastructure creates new attack surfaces for cybercriminals, with potentially devastating consequences for safety and operations.

Data Management Complexity: Extracting meaningful insights from the deluge of data from sensors and smart devices requires sophisticated analytics capabilities.

Workforce Skills Gap: A disconnect exists between the traditional skillsets of the oil and gas workforce and the digital literacy required for the future.

Solutions:

Robust Cybersecurity Frameworks: Implementing multi-layered security protocols to protect both IT and operational technology (OT) systems.

Digital Twins: Creating virtual replicas of physical assets to optimize performance, predict maintenance needs, and simulate different operational scenarios.

AI-Powered Predictive Maintenance: Using machine learning algorithms to analyze equipment data and predict failures before they occur, reducing downtime and improving safety.

6. The Ticking Clock of Aging Infrastructure

Much of the world’s oil and gas infrastructure, from offshore platforms to onshore pipelines, was built decades ago. These aging assets are more prone to failure, pose greater environmental risks, and are more expensive to maintain.

The Challenge: Companies face the difficult decision of whether to invest heavily in upgrading and retrofitting aging infrastructure or to decommission it, which comes with its own set of complexities and costs.

Impacts:

Increased Maintenance Costs: Older equipment requires more frequent inspection and repair.

Higher Risk of Leaks and Spills: The integrity of aging pipelines and facilities can be compromised, increasing the risk of environmental incidents.

Operational Inefficiencies: Outdated technology can hinder efforts to improve efficiency and reduce emissions.

Solutions:

Asset Integrity Management (AIM): Implementing comprehensive programs to monitor the condition of assets and prioritize maintenance and replacement activities.

Advanced Materials: Using corrosion-resistant alloys and composite materials to extend the lifespan of infrastructure.

Robotic Inspections: Deploying robots and drones to inspect hard-to-reach or hazardous areas of aging facilities.

7. The Looming Talent Crisis and Workforce Gap

The oil and gas industry is facing a demographic cliff. A large wave of experienced engineers, geoscientists, and field operators are nearing retirement, and the industry is struggling to attract new talent to replace them.

The Challenge: The younger generation, particularly millennials and Gen Z, often perceives the oil and gas industry as environmentally harmful and lacking long-term career stability. They are more drawn to the tech sector and renewable energy.

Impacts:

Loss of Institutional Knowledge: The retirement of experienced professionals creates a significant knowledge gap.

Shortage of Critical Skills: A lack of qualified candidates for key technical and digital roles is hampering innovation and growth.

Increased Competition for Talent: The industry is now competing with Silicon Valley and the renewable sector for the same pool of digital and engineering talent.

Solutions:

Upskilling and Reskilling the Existing Workforce: Providing training in digital technologies and data analytics.

Improving the Industry’s Image: Highlighting the role of oil and gas in the energy transition and showcasing high-tech, innovative career paths.

Diversity and Inclusion Initiatives: Creating a more inclusive work environment to attract a broader range of talent.

8. Increasingly Complex and Vulnerable Supply Chains

The global oil and gas supply chain is a marvel of logistics, but it is also incredibly complex and vulnerable to disruption. The COVID-19 pandemic and recent geopolitical conflicts have exposed the fragility of these intricate networks.

The Challenge: Companies rely on a global network of suppliers for everything from specialized drilling equipment to catering services for offshore platforms. Any disruption to this network can have a domino effect, leading to project delays and cost overruns.

Impacts:

Equipment and Material Shortages: Disruptions can lead to long lead times for critical components.

Logistical Bottlenecks: Port closures, shipping container shortages, and transportation restrictions can create significant delays.

Cost Inflation: Supply chain disruptions often lead to higher prices for materials and services.

Solutions:

Supply Chain Diversification: Reducing reliance on single-source suppliers and exploring regional sourcing options.

Digital Supply Chain Management: Using technology to improve visibility and traceability across the supply chain.

Strategic Stockpiling: Maintaining inventories of critical spare parts and equipment to buffer against disruptions.

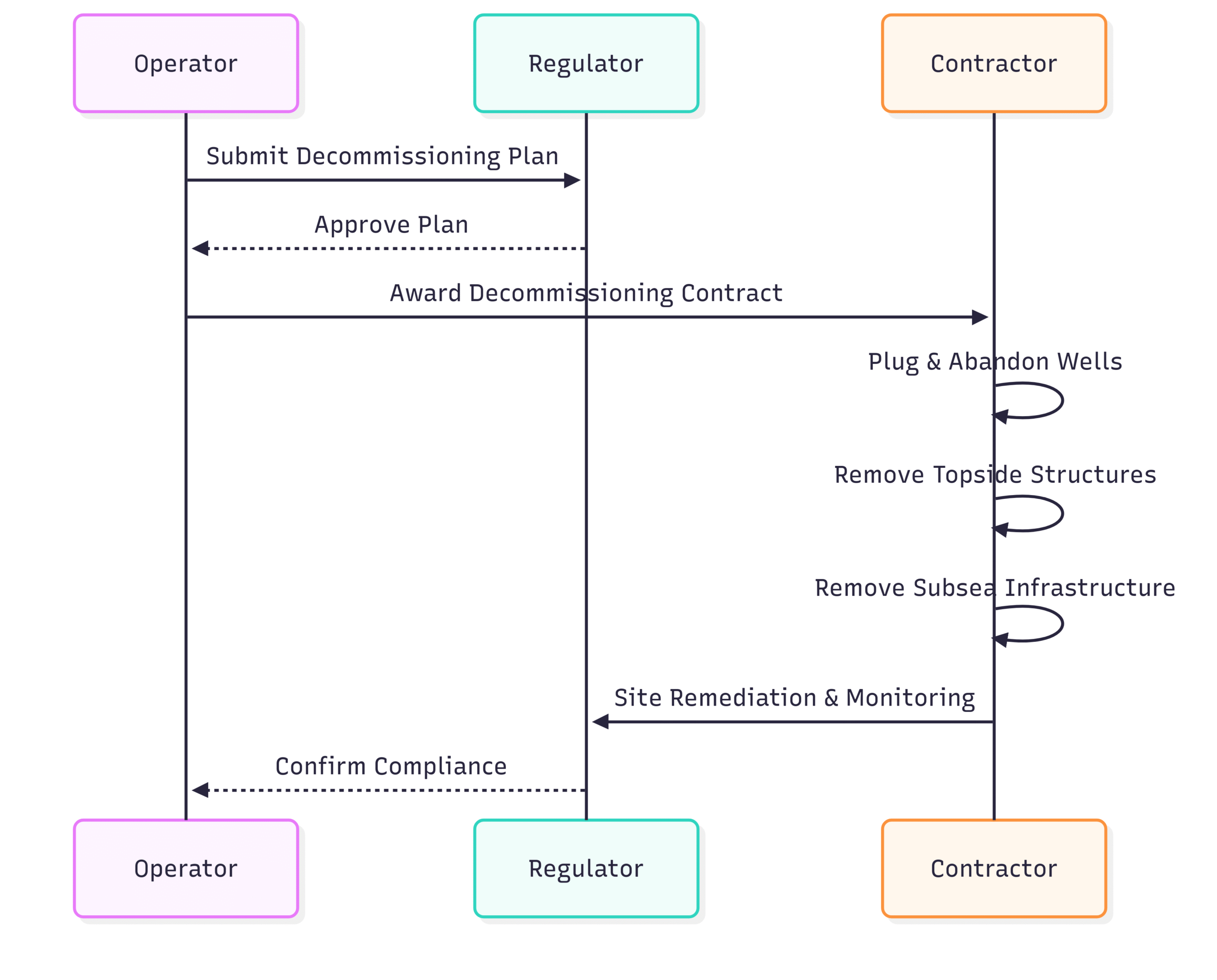

9. The Mounting Challenge of Decommissioning

What goes up must come down. As oil and gas fields reach the end of their productive lives, the infrastructure used to extract and transport the resources must be safely and responsibly decommissioned.

The Challenge: Decommissioning offshore platforms and subsea infrastructure is a complex and expensive undertaking. It involves plugging wells, dismantling massive structures, and remediating the environment, all while adhering to strict regulations.

Impacts:

Massive Financial Liabilities: The cost of decommissioning can run into the billions of dollars for large offshore projects.

Environmental Risks: Improper decommissioning can lead to the release of hazardous materials into the marine environment.

Technical Complexity: Dismantling structures that were never designed to be taken apart requires specialized engineering and equipment.

Solutions:

“Rig-to-Reef” Programs: In some cases, decommissioned platforms can be converted into artificial reefs, creating new marine habitats.

Advanced Cutting Technologies: Using robotic and remote-controlled systems to safely dismantle structures.

Circular Economy Approaches: Finding ways to reuse or recycle materials from decommissioned assets.

10. Exploring and Producing in Harsher, More Remote Environments

The “easy oil” is gone. As conventional, easily accessible reserves decline, companies are being forced to explore for and produce oil and gas in increasingly challenging environments, from ultra-deepwater to the Arctic.

The Challenge: Operating in these harsh and remote locations requires pushing the boundaries of technology and engineering. The risks are higher, the costs are greater, and the margin for error is smaller.

Impacts:

Higher Exploration and Production Costs: Deepwater and Arctic projects are significantly more expensive than conventional onshore projects.

Increased Safety and Environmental Risks: The consequences of an incident in these sensitive environments can be catastrophic.

Technological Hurdles: Developing equipment and materials that can withstand extreme temperatures, pressures, and weather conditions is a major challenge.

Solutions:

Advanced Seismic Imaging: Using 3D and 4D seismic technology to more accurately identify and characterize reserves.

Subsea Processing: Moving processing equipment to the seabed to reduce the need for large, expensive surface facilities.

Remote and Autonomous Operations: Using robotics and automation to reduce the need for human presence in hazardous environments.

Conclusion: The Dawn of a New Energy Era

The challenges facing the modern oil and gas industry are formidable, but they are not insurmountable. This is not an industry in decline, but one in the midst of a radical transformation. The companies that will thrive in this new era are those that embrace innovation, prioritize sustainability, and demonstrate the agility to adapt to a rapidly changing world. The road ahead will be complex, but for those willing to meet these challenges head-on, the future of energy holds immense opportunity.